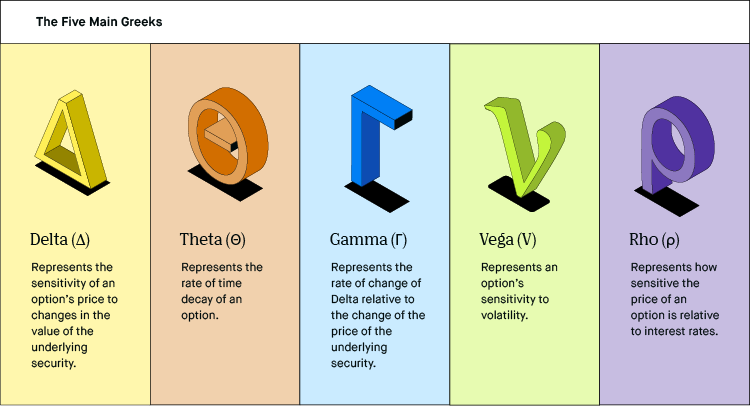

For many beginning traders, entering the options trading world can be daunting. With a myriad of technical terms, complex calculations, and unfamiliar principles, it’s no surprise that newcomers may feel overwhelmed by the complexity of their new endeavour. However, understanding these terms is vital to successful options trading – specifically delta, gamma, vega and theta – since they each represent different risk factors associated with option pricing.

In this article, we’ll break down each of these concepts so you can better understand how they affect your trades and relationships with other market participants. So read if you’re seeking answers to some basic questions about derivatives trading.

What is Delta?

Delta measures the amount an options price will change when the underlying stock moves one point. It’s expressed as a number between -1 and +1, with a delta of 1, meaning the option will move in lock step with its underlying asset. For example, if an options contract has a delta of 0.5, its value will increase or decrease by half a point for every full-point change in the underlying share.

When options trading, it’s vital to understand delta because it helps you understand what effect changes in the market can have on your options positions and how much risk you take.

What is Gamma?

Gamma measures how quickly delta increases or decreases as the price of an underlying asset moves. It’s calculated by taking the derivative (the rate of change) of delta concerning the stock price. In other words, gamma measures the speed at which delta will change when the share price moves up or down.

For example, if a call option has a gamma of 0.5, then for every full-point move in the underlying stock’s price, delta will increase by 0.5 points. It is essential because it helps you understand how quickly your options positions can turn from profitable to unprofitable (or vice versa) and what action you need to take to limit your risk exposure or maximise your advantages.

What is Vega?

Vega measures the amount an option’s price will change when volatility increases or decreases by one percentage point. It’s expressed as a number between -1 and +1, with a vega of 1, meaning that the option’s price will increase (or decrease) by an entire percentage point for every full-point move in volatility.

Understanding how vega works are crucial because it helps you understand how changes in market conditions can affect your options positions. For example, if market volatility increases, options prices tend to increase as well, so understanding vega can help you manage your risk accordingly.

What is Theta?

Theta measures the time decay of an option. It’s expressed as a number between -1 and +1, with a theta of 1, meaning that the option will lose (or gain) one point in value for every day that passes.

Understanding how theta works are crucial because it helps you understand how quickly your options positions can deteriorate due to time decay. If you are trading short-term options, you need to be aware of the effect time can have on your positions and adjust your strategy accordingly.

Why is it essential to understand Delta, Gamma, Vega and Theta?

Understanding delta, gamma, vega and theta is crucial because each represents different risk factors associated with option pricing. As a trader, you need to understand these concepts to manage your options positions better and limit your risk exposure.

Having a firm grasp on these four terms, you can calculate how much money you can make or lose from any given position and determine when it’s time to adjust or exit a trade to maximise your advantages or minimise losses. With this knowledge, you can better understand how market conditions may influence your trades and make decisions that suit your trading goals and risk tolerances.

Understanding delta, gamma, vega, and theta is essential for successful options traders. With this knowledge, you can make informed decisions tailored to your trading style and goals. In addition, you will better grasp how changes in the market might affect your trades – allowing you to adjust accordingly and limit risk.

Conclusion

The bottom line is that if you want to be successful with options trading, then it’s important to understand delta, gamma, vega and theta – and how these terms interact. Doing so will give you a better chance of making lucrative trades while limiting risk exposure. So, take the time to familiarise yourself with these key concepts, and you’ll be well on your way to successful options trading.

More Stories

Ensuring Clean Water: The Importance of Water Filtration System Installation

Key Considerations For The Best Commercial Cleaning Services

5 Benefits of EV Charging Stations for Businesses